As the construction industry races to eliminate non-value-added work in anticipation of a projected steady increase in demand for excavation and earthwork, products are coming to market to address the often-overlooked bulk hauling business for soil, aggregate, demolished concrete and other heavy civil materials.

The underlying marketplace for fill material and dump site capacity also drives budget and schedule uncertainty. Contractors and haulers that need or must get rid of materials have historically faced a disconnected process of email and phone calls to find materials or a site, find a hauler and manage the flow of materials on and off the site. On January 23, San Rafael-based Bulk Exchange publicly rolled out its online materials marketplace aimed at digitally transforming this space.

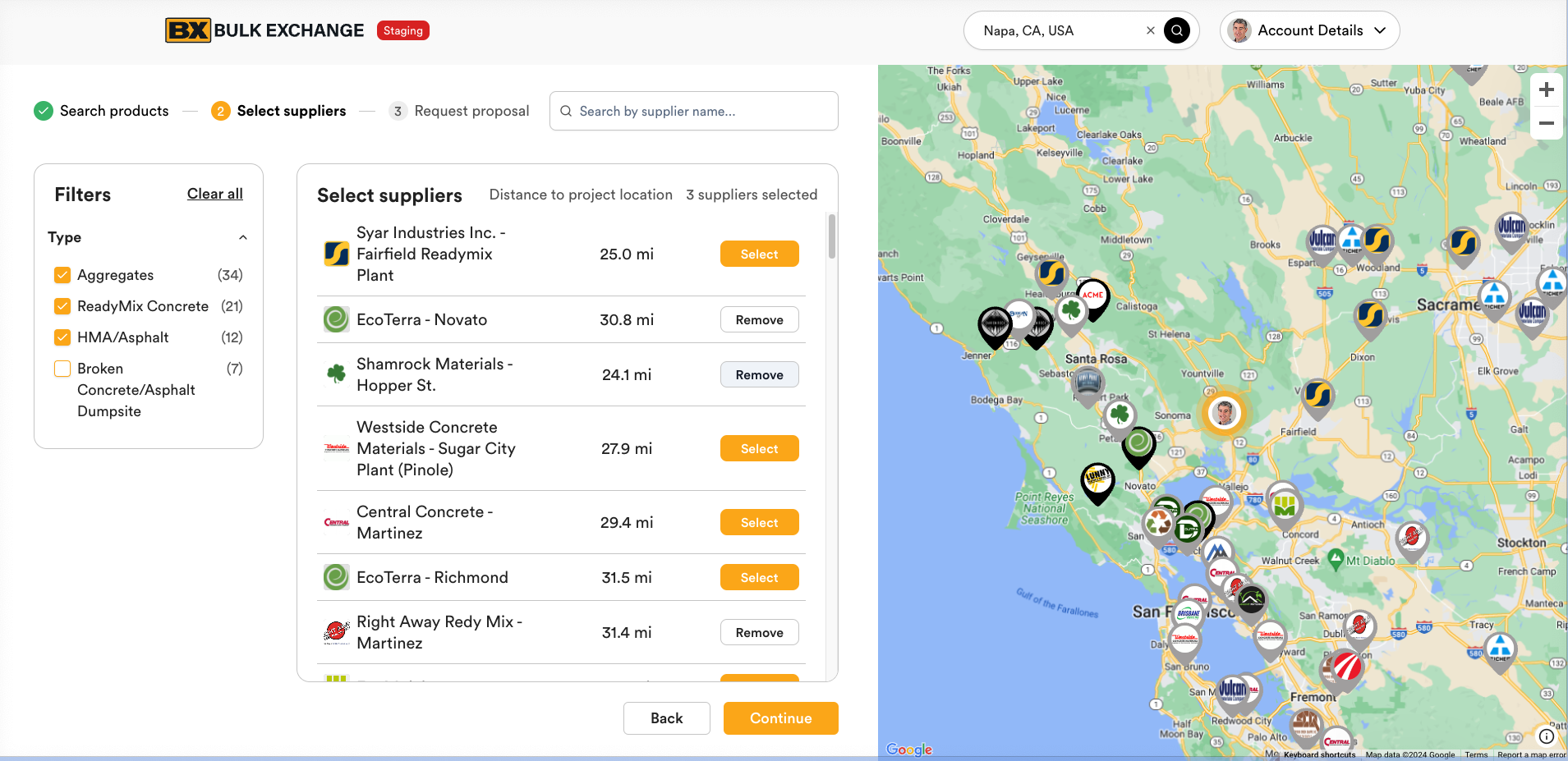

“This function is very reliant on word of mouth, who you know what you know, even in your own backyard,” Bulk Exchange Co-founder and CEO Paul Foley said. “And certainly once you go outside your own familiar work area, it's almost like you're operating in the dark. What Bulk Exchange does is provide the ability to jump on our platform, and look for asphalt, concrete or three-quarter-inch drain rock. Or maybe you’re looking to dump broken concrete or green waste or dirt. In real time, you can see prices you can plug into estimates, all the facilities that carry that product or accept that product in the area including their gate rates.”

An estimator or contractor can then reach out with RFPs to facilities to get customer-specific pricing.

Bulk Exchange encompasses both the demand-side from contractors and the supply side of bulk materials including quarries, supply yards, recycling facilities and dump sites. This requires a high degree of localization, and Bulk Exchange’s initial focus will be on Northern California with parallel efforts to roll out other top local markets identified by customers and integration partner HCSS.

“This year, we are conservatively targeting to open up 20 of HCSS’s top 20 markets,” Bulk Exchange Chief Strategy Officer Rachel Mahoney said on a January IRONPROS debriefing call with Bulk Exchange leadership. “They've given us a list of those markets where they have the highest volume of business, and we have aligned our strategy for growth to accommodate those top 20 markets. That's pretty conservative, and we hope to exceed that—by the end of 2025, we aim to be in every market that they're in now. Part of our partnership is internal marketing and sales to their user base. And then, to complement that on the supply side we've aligned ourselves with a couple big national supply and dump or waste companies. We'll have the demand from HCSS and their customers coming on board nationally as well as the supplier side of the marketplace.”

According to Mahoney, a workable market for Bulk Exchange will include roughly 500 dumpsites or suppliers about 2,500. contractors. The market would be considered fully open with about 25% adoption in that geography.

Bulk Exchange is not a first … Manchester-based Soil Exchange offers a somewhat similar service in the United Kingdom. Founded in 2018, Plainview, N.Y.-based Soil Connect offers a slightly different model—Soil Connect Co-Founder and CEO Cliff Fetner characterizes app availability as nationwide, but acknowledges they are more successful with matching buyers and seller when they launch and hyper focus on a specific area at a time. Current focuses include markets in the New York metro area, Texas and markets in the Midwest, with a growing number of markets in 2024.

“I have seen a couple of them through the years,” Fetner said. “Some have been local, and one or two have been in Canada. Our own model has gone through various forms, but today our elevator pitch is we are a soil management solution. By leveraging technology, we are able to help you buy, sell and move, track and transport better and more efficiently, saving you money!”

Bulk Exchange is focused currently on Northern California but plans to roll out to 200 or so markets in 2024.

Heavy Civil Materials Logistics Problem

Bulk civil construction materials hauling is probably not on the radar screen of many professional investors, so it took stakeholders from inside the industry pitching the idea to each other to ramp up solutions like Soil Connect and Bulk Exchange. Bulk Exchange CEO and Co-Founder Paul Foley for instance came up in his father’s excavation contracting business in Ireland before taking on construction project management and launching his own contracting businesses. Fetner came from a background in residential construction, and received investment from customers including ARCO/Murray, largely out of enlightened self-interest.

“Through their investment venture side, they have participated in a couple of our rounds,” Fetner said. “And they have received that amount of money back on the operations side in savings.”

Meanwhile, Bulk Exchange’s investors include Junk King Founder and CEO Mike Andreacchi, Canyon Rock Quarry & River Ready Mix Co-Owner Jonathon Trappe and Ranger Pipelines President CEO Tom Hunt.

While the founders and backers are from the industry, Bulk Exchange brings in senior leadership with experience beyond construction and into the scaling of digital business models. Mahoney owns a stake in a construction company. But she also sold CareerGig, her last online marketplace business, in 2022 to Alef. Bulk Exchange Chief Technology Officer Paul Whyte brings a background in technology leadership in fintech, telecom and hands-on development.

Whyte explained that while Bulk Exhange is relying on external development partners for development and user experience, Whyte’s presence distinguishes it from some construction technology startups that may not have a senior technologist until later stages. This may lead to growing pains later because decisions made and directions taken early are important as a product evolves.

Whyte was on board during early days, and today Bulk Exchange is a Google-based platform on the Google Cloud Platform.

“One of the key traits of any good technology company has been the ability to scale and pivot really quickly,” Whyte said. “So we've laid all of that groundwork. Typically, one of the bottlenecks that startups run into when they get to scale up stage is they get something to market really quickly. They cobble it together and when it gets that scale up scale stage, it doesn't scale at all. We've circumvented all those problems specifically, because we know the opportunity ahead of us.”

Fetner meanwhile has an ambitious roadmap for Soil Connect. The company is currently helping customers augment their customer’s data with drone flyover data of their site to support operations, with a plan to automate and productize it within the platform.

Brokerage Versus Transaction

The emergence of two materials platforms with national aspirations signals to IRONPROS that this is an emerging category. Each product will scale into various markets at different rates and will overlap. The differences between the two may consist of relationships and how they charge marketplace users.

Soil Connect relies on a brokerage model.

“When we find and broker dirt, we are charging 50 cents a yard to get rid of for you,” Fetner said. “This includes access to our base analytics page so you can quantify the amount of dirt being used in a week or a month and view predictive analytics of when you will be done moving dirt. Based on that information, the operations team can make other decisions in terms of scheduling the other trades. Those that are familiar with the dirt world already know that 50 cents a yard is already heavily discounted, and they are getting a comprehensive package with that.”

BulkExchange meanwhile charges a two- to low three-figure monthly subscription for a demand-side or contractor organization or low three-figures for a supplier site.