A research report released Feb. 17 by Trimble and Dodge Construction Network details how project owners are now the chief drivers of digital workflows—automated and integrated construction business processes that replace paper-based or manual tasks.

The study report, Connected Construction, the Owner’s Perspective, focuses on owners but because the subject matter deals in part with automation of inter-company processes, 236 general contractors and 232 trade contractors were also included in the sample. And while Trimble and Dodge told ForConstructionPros on a call prior to study release that there will be another report specifically about contractors, the data says owners are digitizing and taking their contractor partners with them by mandate.

Takeaway #1 Contractors Must Adopt Digital

“Contractors should anticipate the requirements of owners, and right now 85 percent of owners are implementing digital transformation now, moving that from internal to external processes,” President of e-Builder and General Manager and Trimble General Manager and Vice President Greg Blackman said. “The big thing is for contractors to be ready to start engaging and working through digital means. We can see in the data itself—the main thing is contractors need to be ready to start engaging and working through digital workflows and that will be a big differentiator in terms of earning the business and being able to collaborate in those workflows.”

While in the past contractors were perhaps leading the charge on pushing for a digital workflow with owners, in part to speed application for payment and change order approvals, the tide seems to have turned.

“The big thing is that owners are doing it and they are leading it and I don’t think that was the case in the past,” Blackman said. “Owners were being driven to it—they are driving it now, and they are doing a lot to reinforce it among their generals and subcontractors.”

Study results say 80 percent of project owners in the study said they used digital workflows not just internally but externally with their project teams including contractors and designers. Of that 80 percent, 69 percent of owners said they were specifying contractors use digital documentation practices very frequently or frequently. Furthermore, 52 percent rely on digital workflows for less than 50 percent of project data, 16 percent for between 50 percent and 74 percent of project data and 12 percent for 75 percent or more of project data.

And of those owners using digital workflows with their external project teams though, only 12 percent were very satisfied with the resulting level of connectedness. This would seem to suggest owners will be demanding even greater levels of transparency and deeper visibility into contractor business activities, work put in place, project risk and other dynamics.

Trimble-Dodge Construction Network

Trimble-Dodge Construction Network

Takeaway #2 Root Cause of Construction Delays and Errors Matters

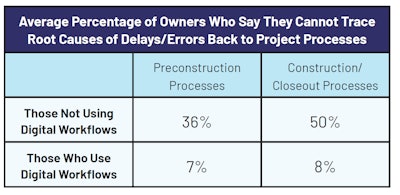

One of the main benefits to owners of an inter-company digital workflow, according to study results, is the ability to trace errors and delays back to their root cause. The good thing for contractors is that they, too, can benefit from greater transparency into project issues as many times they are not their fault. After all, issues at any stages at the project, once clearly attributed, may cause discomfort for whoever is at fault but exonerates others.

Contractors are actively adopting some systems like inter-company change order applications and field communication applications to create this clarity so they can speed up budget changes and approvals and clearly document what has been done.

And per the study results, digital workflows make an owner six times as likely to be able to track errors and delays to the source. Which is good news for diligent contractors too who may otherwise be blamed for problems caused by a nebulous design document or request for proposals, faulty workmanship or a sluggish materials or component supply chain.

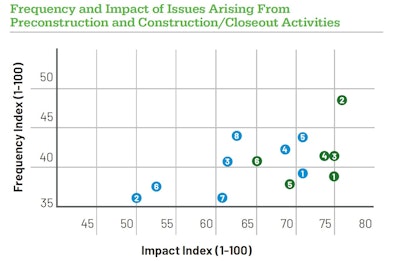

In the study, the most frequently reported construction activities where owners were negatively impacted by issues in a connected construction process were:

Budgetary and Approval/Change and

Project Closeout, tied at 44 out an index of 100

The elements that sored the highest in terms of impact from errors and delays caused by processes though were:

RFIs and

Budget Approval/Change, Changes, tied at 77 out of an index of 100

That leaves budget approvals and changes as perhaps the most significant source of pain since it is both very frequent and highly disruptive

“Specifically on the construction side, budget changes, potential change orders, RFIs—if you look at the data in the report, you can see where owners are seeing the value and where they want to be able to collaborate with the contractor,” Blackman said.

The more contractors digitize their own processes, the more visibility they and by extension owners can get into root cause of problems.

“They need to take advantage of digital workflows inside their organization,” Blackman said. “Maybe that means digitizing the drawings themselves or handling design review components digitally. They need to be thinking ahead on some of that—embracing the tech.”

And contractors do seem to be embracing more technology—Procore alone has 3,994 customers according to one source, which is estimated at 5 percent market share. Back of the napkin math suggests that makes the total number of companies running similar software 79,880.

“We did a study with Viewpoint a couple of years ago that looked specifically at where contractors were in terms of their digital transformation and gathering of data and it did suggest that they were even back about two to three years ago were already moving from Excel spreadsheets, depending on the contractor, but definitely strongly moving from them,” Dodge Data & Analytics Industry Insights Research Director Donna Laquidara-Carr said. “We saw a great deal of data on the contractor side with the understanding that they need to have data that is not just current, not just accurate, but is comparable and able to be used in different circumstances. Contractors do seem to get that—it is just the challenge of getting to that point.”

And while contractors have been growing in their technological sophistication, owners are now pulling ahead and pulling them along in their backdraft.

“Historically, the contractors have been taking some of these ideas to owners. The thing here is that this is now being embraced by the owners,” Blackman said, adding that the focus must not be on contractors’ internal processes but where data is handed off between those engaged at different points in the project or asset lifecycle. “It is about how you collaborate and interact, eliminate duplicate entry and ensure there is clear transparency. You still own your data and can do things with it as you did in the past. But it needs to be shareable outside the organization.”

Takeaway #3 General Contractors are Piggy in The Middle

The most frequent communication breakdowns owners reported were with general construction and construction managers, yet they were also the most likely to use a digital workflow with external parties.

But this does not mean subcontractor or specialty trade contractors are better at digital workflows or communication than generals.

“When you look at where the breaks occur, it is where there is less connection in digital collaboration,” Blackman said. “I think the owner, while they are a layer removed, still winds up dealing with the impact of that lack of communication.”

“They also report that they have more breakdowns with GCs than designers,” Laquidara-Carr said. “The telling point is how critical that connection is between owner and GC. I was surprised it was not equal to designers, but they saw the generals as the primary point of concern.”