Thanks for joining us on Construction Tech Talk for another of our Product Snapshots. This is Technology Editor Charles Rathmann.

Today, we’ll look at a portfolio of projects that illustrates two trends in construction business software. The first--the future of construction software is multi-tenant software as a service or Sass. The second is that on-premise software gets new life when it’s integrated with cloud-based applications. We’ll see how all of this works first-hand as we talk about the Sage 100 Contractor, Sage 300 CRE and Sage Intacct products.

So UK-based Sage Group is the third largest ERP software vendor behind SAP and Oracle—publicly traded on the London Stock Exchange—with tens of thousands of employees. Many other construction tech companies are much younger and smaller. And Sage is doubling down these days on construction with a trio of accounting and ERP packages including Sage 100 Contractor, Sage 300 Construction and Real Estate and Sage Intacct.

All three of these products came by acquisition.

Sage bought Timberline in 2003 which is now Sage 300 CRE. Then in 2006, Sage bought Master Builder, which is now Sage 100 Contractor. Between Timberline and Master Builder, Sage acquired six thousand construction customers.

Now both of these applications can be purchased as hosted solutions in the cloud, but they were designed for on premise. And that‘s just not the direction the zeitgeist is headed. Software designed for on-premise is harder to access by remote workers or field crews, harder to integrate with and more expensive for Sage to develop than sass. Sage is doing what they can here. Sage 100 and Sage 300 had systems integrator hh2 to create some web services that make some functionality available online, and there are also connectors available for Sage 100 Contractor and Sage 300 CRE from the integration platform as a service provider Ryvit. Various other cloud packages like AvidXchange accounts payable also have integrations. These Sage products extend into project management and operations through integrations with tools like Procore and RedTeam.

The lesson is, old software can learn new tricks when you connect it to cloud software that reads and writes to that legacy solution. So if came up using Timberline or Master Builder, they are here for you. And Sage has made them more viable through integrations.

But there is no substitute for a real cloud-first multi-tenant sass product so in 2017, Sage bought accounting software company Intacct.

Between these three software products, Sage now claims about 50,000 construction customers using the software on about 500,000 projects including about 7 million subcontracts. Sage has these solutions positioned for different parts of the market—Sage 100 Contractor’s aimed at small to medium construction, contract and service businesses. Sage 300 CRE, more customizable, and extends well into contractor-owners that manage properties post-construction. But I would expect Sage to lead with either Sage Intacct or Sage 300 CRE in sales cycles with contractors over 20 million dollars in revenue and Sage 100 Contractor with contractors under 20 million dollars in total construction volume.

So let’s take a quick look at each of these products.

Sage 100 Contractor has broad functionality from the general ledger through to payroll, project management, equipment management, estimating, scheduling, service receivables, inventory and reporting. But these tools are first and foremost the default financial solutions in the industry so we’ll focus on the white collar stuff.

We’ll start with Sage 100 Contractor. Here in estimating we see a price list for various components used in a project that might allow you to add parts or update pricing including default cost. The focus on rolling up costs and table-based views is very recognizable to heavy ERP users.

You can export the finished estimate into a proposal for the customer and, once you win the work, into a budget and a schedule and subcontracts. You can order work tickets and even go back and do additional takeoffs for detailed change orders.

Construction takes place on a schedule, so the software lets you generate a Gantt chart with start and stop dates and float for various tasks, breaking things down by the month, week, quarter, month and year.

Now—let’s look at Sage 300 CRE … which as the name implies extends not only across construction project operations, but into the property and asset management lifecycle

Keep in mind these are very broad applications and we can’t really even make a dent in a short video. Sage 300 CRE as the name implies

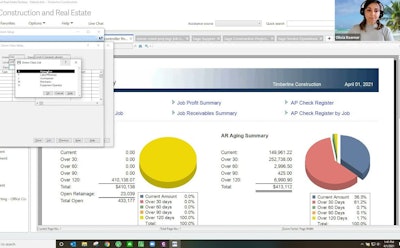

But the ability to visualize data is important, so let’s look at some dashboard capabilities.

A dashboard contains one or more tiles, and each tile presents data from one or more report. Even if you have more than one dashboard, Sage 300 CRE lets you aggregate data from across these databases.

You can add data sources, drag and drop to resize the tiles, add more report parts. Here is the Job Cost Report and we can grab the cost type summary for display in the dashboard.

And Bam—there it is.

There is a lot more you can do with Sage 100 Contractor and Sage 300 CRE—I just want to give you a taste. Now we’ll look at Sage Intacct, and you may notice this is a more modern, cloud-native product.

Sage Intacct feels more web-like in its navigation. There are some intuitive things here—each numerical figure you see in blue—yeah, that’s a link so you can drill down to the data sources that drive that number. And you can open any of the components of the dashboard with a single click in Excel.

Again, these are broad enterprise solutions, and when you talk to a reseller you can go over your specific use case and how the software will handle it.

But what’s really critical about Intacct is not what’s on the screen, but what’s under the hood. This is a multi-tenant Sass product so there is just a single version of it running for all users, with their proprietary data and processes segregated of course. That means it’s always updated and patched and every user gets the latest features right away. It’s designed from the ground up to be accessed over the web, supports more than 300 API methods through specific APIs to support different integrations. It supports API integration standards like XML-RPC and has an API test tool so you can make sure your API calls work.

Through the Sage Intacct Marketplace—customers can also find a growing list of certified direct and third-party integrations between Intacct and dozens of other solutions.

Now these are all tired and true products. We won’t see a lot of fancy headless architecture or in-memory databases common in newer, leading-edge software.

Sage 100 relies on Microsoft SQL database and Sage 300 uses Pervasive SQL for day-to-day transactions and Microsoft SQL for reporting. Intacct is on an Oracle database, and the Oracle database does have in-memory capabilities. The solutions are hosted in a proprietary Sage cloud environment. If I was evaluating Intacct and had concerns about how available some data will be for frequent querying, I’d ask my Sage partner how these in-memory features can be exposed in the application.

So let’s talk about price.

Sage has made its pricing strategy clear. For Sage 100 and Sage 300 the goal is to move the entire established base that bought perpetual licenses onto subscriptions. So if you’re wondering how that works, Sage is identifying a three- to four-year break-even point balancing the cost of a subscription with the cost of the customer care plan they already pay for on an ongoing basis. Sources at the company tell me this has been well-received.

Now these are enterprise accounting and ERP products, sold by and implemented by value-added resellers … so in addition to an annual subscription there will be an up-front implementation cost. But my guess is that the biggest net new sales push and probably the overwhelming majority of research and development dollars for new features will go to Intacct.

Using a handy price estimation tool available on Intacct reseller sites, a company with 20 business users, 60 employee users and no additional business entities or divisions would pay about a hundred fifty thousand dollars per year for Intacct and a one-time implementation cost of just over a hundred three thousand. These figures can go up as the company and use case becomes more complex.

So here is the bottom line on Sage’s construction portfolio. These are the industry standard finance solutions, dedicated to the construction space and backed by a global leading software vendor with a substantial ecosystem, user groups and infrastructure. Sure, you can find long reach and a deep bench at companies like Netsuite or Acumatica, but they may lack depth in job costing, change management, and industry requirements like retainage. And while Sage 100 Contractor and Sage 300 CRE have deep construction capabilities, Sage is investing heavily in Intacct. Their stated goal is to move the Sage 300 Contractor base over to Intacct, but they need to get that solution functional parity to make that viable. They have already built out some cool stuff including enhanced contract management, ability to track committed costs and a more flexible approach to the project subledger. They also announced a new partnership, operative in November, to roll out enhanced construction payroll functionality by whitelabeling an advanced new solution from Penta. So I’d look for Sage Intacct for Construction to keep getting better and winning new converts.