The marriage of construction site photogrammetry with computer vision and building information modeling (BIM) is rapidly changing the way contractors capture and report progress against the project plan, and no single company has lead the charge in the North American building construction market on this front like San Francisco-based OpenSpace.

The company employs more than 250, with a large enough salesforce at about 70 to continue its growth trajectory, and a customer success and support team of more than 50 to ensure existing customers feel the love and can grow in the solution. Recurring revenue from software subscriptions and more than $200 million in external funding provide a solid platform for growth. The company continued to receive Series D late stage venture funding as recently as August of 2022, through Taronga Group and GreenPoint Partners, proving that expert investors performing heavy analysis continue to see potential and strong position with OpenSpace. The company has raised a total of $111 million in Series D funding alone.

At the time of our latest briefing with OpenSpace, the company had 7 billion square feet of construction captured on 10,000 job sites. Their customer base includes some free version users, but the majority are paid according to company sources, and the company claims to be converting free to paid users at a rapid clip. While they enjoy a dominant position in North America, they are also launching distribution in EMEA (Europe, the Middle East, and Africa) through value added resellers (VARs) Sektor and in India through Enhance.

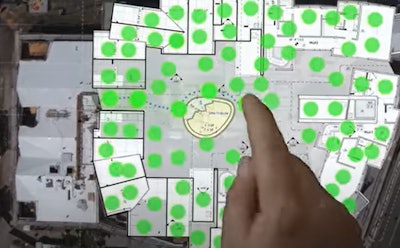

OpenSpace may have more operational heft and North American customers than rivals including recent arrival, Constru, which established beachhead here this year. But they are not sitting on their laurels, opting instead to deepen and broaden the product on an ongoing basis. Central to these efforts is the OpenSpace Clearsight Progress Tracking product, which, using machine learning and computer vision, quantifies work put in place on the jobsite, creates dashboards and updates a BIM model. OpenSpace handles data collection through a 360-degree camera mounted to a construction helmet, and a site walk-through is all it takes to update progress with both photogrammetry and structured data reporting thanks to the way their machine vision tools unpack the visuals into a structured format.

“We are always working on enhancing features in our core product, Capture,” OpenSpace Solutions Engineering Manager Adam Settino said in an April, 2022 debriefing. “We just had our one-year anniversary of our ClearSight progress tracking tool, and are working on making sure all the trackers available for critical path in construction. We are about 70% there, and are adding in some of those additional features—tying them to product tracking and integrating them with BIM.”

Some of this capability comprises net new product; ClearSight, the newer add-on to the core product, Capture. Collectively, the OpenSpace offering includes 360 data capture and viewing, day-to-day progress comparisons, BIM integrations with Procore, Autodesk BIM 360 and PlanGrid. Also newer in the Capture product is 3D Lidar scanning on iPhones and iPads and functionality for recording field notes. With new product to drive new revenue and engagement and deeper tools and functionality for the core product, OpenSpace seems to be well-aligned tactically to grow in the construction photogrammetry and progress reporting categories for building construction.

In a recent survey of its customers, OpenSpace found that 67% of customers reported saving thousands of dollars on average on project costs thanks to OpenSpace, while 74% saved multiple hours per week. These savings are a result of OpenSpace Capture's ability to increase site coordination, reduce rework costs, and provide a trusted, complete record of site status. Customers like RG Construction, a specialty drywall contractor based in Chicago, have seen the benefits of OpenSpace for more efficient construction.

"OpenSpace is the single best tool we've had in terms of jobsite information," RG Construction Principal Brian Garcea said. "Having real-time insight into our progress that lets us quickly adjust how we're working in the field is what lean is all about. It's an invaluable tool for our company."

Long term, OpenSpace provides value by automating workflows for progress reporting, application for payment and as-built documentation. In an environment where many of the large general contractors try to address these processes with internal development and data science teams, OpenSpace delivers a leading, broadly-adopted commercial-off-the-shelf product that democratizes photogrammetry documentation for large and middle market contractors alike. As a middle-market sized company itself, it has the resources and revenue to develop, sell and support the product. It has a strong footprint with North American general and trade contractors, including many of the larger ones, and has at least some customer footprint in over 70 countries. Company sources suggest building the international footprint will also be a priority.

OpenSpace tech stack

OpenSpace is provisioned on Amazon Web Services (AWS) as an orchestrated, containerized system that runs on nodes in multiple availability zones, segregated into several data regions. To guarantee maximum availability, the nodes run behind an application load balancer.

The product relies on multiple open-source libraries, and to they are up-to-date, they are scanned by automated tools at least daily and patched based on the prioritized assessment of risk. Unpatched open source software products can result in security vulnerabilities as potential exploits are left open. OpenSpace’s research and development team ships new code is deployed daily, which further tightens data and application security. Periodicity for significant releases varies, with each release coming after a beta period with customers.

Sources at the company suggest future development will focus is on:

- Making data capture and progress reporting easier

- Deepening integrations with PlanGrid, Autodesk Construction Cloud, Procore, and others

- Deepened features for virtual design and construction (VDC) professionals, including updates to 3D Scan and BIM Compare offerings

- Expanding automated progress tracking, adding trackers for mechanical, electrical and plumbing (MEP) and flooring

- Expanding BIM integrations

- Adding features that streamline larger-scale use including walk scheduling and new ways to navigate a multi-project experience

One other tech-forward approach to construction site data capture is the Trimble-Boston Dynamics Spot the Construction Robot collaboration. The quadrupedal robot, Spot, does the walking, carrying a Trimble X7 laser scanner around the site, collecting point cloud information and 3D imagery while saving the time of a human worker walking the site.

“We look to our customers to help us understand what integrations make sense for them, Settino said. “Right now, what they are telling us is that simply walking the jobsite with a 360-degree camera works. In terms of the future, we do have a relationship with Boston Dynamics and see some interesting use cases for Spot in places that present safety risks to people walking the jobsite. This is something we will explore further as our customers pull us in this direction.”

While Spot uses laser scanning, OpenSpace captures video at two frames a second, and does not rely on any external cell connection or GPS or GNSS signal. This means a contractor can capture data even without a reliable data connection, and then transfer files using a cellular data connection, USB or wifi. The imagery will be automatically recognized as the latest walk and added to the BIM.

Supported cameras currently include:

- Ricoh Theta Z1

- Insta360 One R

- Insta360 One X

- Insta360 One X2

- Ricoh Theta V

- Garmin VIRB 360 (discontinued by manufacturer)

OpenSpace pricing and market

Openspace sells the solution hardware, including 360-degree cameras, at cost.

The methods OpenSpace uses to price their software products have evolved as their market footprint has grown. Currently, the company relies on an annual subscription model based on the extent of OpenSpace functionality a customer uses combined with the annual volume of construction being tracked.

This gives customers an unlimited number of projects and users and unlimited captures. Larger users can negotiate pricing, with those negotiations including auditing methodology. When dollars of construction put in place per year goes from millions to billions for an OpenSpace user organization, the percentage fee goes down in relation to the construction value. But our sources in the company suggest OpenSpace will discount less than some competitors, who may slash prices significantly from the reate card, in part to make up for comparatively lower value delivered.

OpenSpace has been broadly adopted by contractors ranging in size from the ENR top contractors to mid-tier contractors with a few hundred million in revenue to small mom-and-pops. OpenSpace offers a free version that may be a fit for the smallest contractors, but the cost to a small contractor that opts into a paid subscription will be based on their construction volume. A contractor constructing single family homes could be a fit, as could the largest subcontractors in the world working on horizontal construction.

The best fits for OpenSpace and its approach include contractors executing projects with heavy regulatory and documentation requirements and high complexity including hospitals, research facilities, multifamily and hotels. These projects often feature repeating floor types and room types. Horizontal construction like highway and civil projects are often better served by drone photogrammetry and data capture, but some still rely on OpenSpace for certain projects. Other edge use cases include contractors involved in prefabrication or off-site construction.

“One customer is prefabbing a lot of systems on one side of the world and then sending it to site—capturing data with OpenSpace and then opening that on site,” Settino said.

BOTTOM LINE: There are a number of construction technologies that simply digitize existing processes in construction—that is just digitization. With OpenSpace, we see cloud computing, digital imaging, and computer vision coming together to deliver real digital transformation—using this technology, contractors can achieve things in ways they just could not before. OpenSpace is not alone in pursuing this technology product category, and their newly-landed competition Constru is a bit further along in providing analytical insights from images and triggering business activities, identify risks and surface opportunities. But OpenSpace ought to be able to catch up on that product development front faster than Constru or others can catch up with OpenSpace’s market position and ease of use.